During the 2025 Legislative Session, Senate Bill 2012 (SB 2012) was passed amending the distribution known as "Operation Prairie Dog." A copy of the final bill can be found here.

Oil and Gas Gross Production Tax Distribution Changes:

"Operation Prairie Dog," as it had been dubbed and created by House Bill 1066 during the 66th Legislative Assembly (2019), made numerous changes to the oil and gas gross production tax distribution formula and provided for a new source of infrastructure funding for cities, counties, and townships in non-oil-producing counties and airports throughout the state.

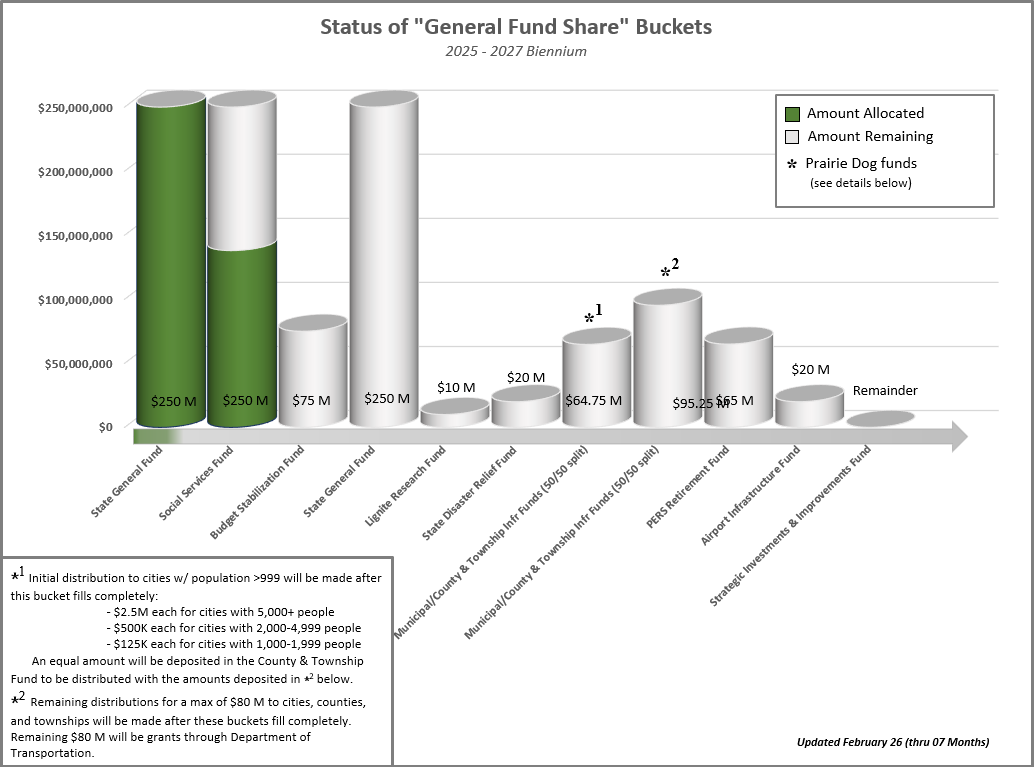

In 2025, SB 2012 reduced the allocations to the infrastructure funds from $250,000,000 of oil and gas tax revenue per biennium to $180,000,000 and moved the infrastructure fund "bucket" up so it may fill earlier in the biennium. In addition to reducing the allocations to the infrastructure funds, SB 2012 appropriates 50% of the funds related to the Municipal Infrastructure Fund and County and Township Infrastructure Fund as a direct distribution from the Office of State Treasurer and appropriates 50% of the funds to North Dakota Department of Transportation for grants. For more information related to grants through Department of Transportation (DOT), please visit DOT's website detailing grant and funding programs.

To see how the oil and gas tax revenue will be distributed under these changes, along with how they have been distributed in the past, click here.

Infrastructure Funds:

SB 2012 allocates up to $180,000,000 of oil and gas tax revenue per biennium to infrastructure funds as follows:

- Municipal Infrastructure Fund - $80,000,000

- County and Township Infrastructure Fund - $80,000,000

- Airport Infrastructure Fund - $20,000,000

For information regarding timing, project eligibility, and reporting requirements for the municipal and county/township funds, please click on the specific fund above. For further information regarding the Airport Infrastructure Fund, please contact the Aeronautics Commission.

Status of Funding (through February 2026):